In 2023, pastors have similar perceptions of the economy as in 2022, with half saying it is having a negative impact on their church.

By Marissa Postell Sullivan

As churches continue to navigate economic challenges in the United States, many pastors say the economy is still harming their churches as giving fails to keep up with inflation.

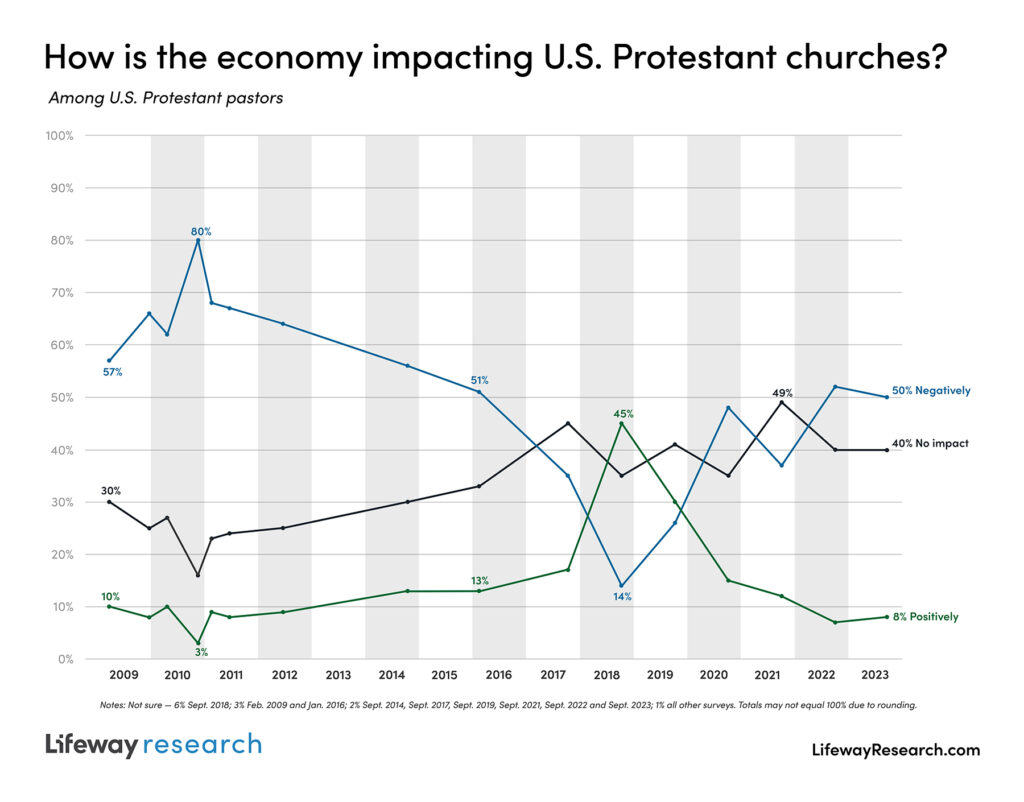

A Lifeway Research study of U.S. Protestant pastors found 50% say the current economy is negatively impacting their churches. Meanwhile, 40% say the economic circumstances aren’t having an effect. Fewer than 1 in 10 (8%) say the current economy is a positive factor for their churches.

50% of U.S. Protestant pastors say the current economy is negatively impacting their churches. Click To TweetAfter last year’s decline in economic optimism, today, pastors have similar perceptions of the economy’s impact as in 2022. Last year was the first time since 2016 that more than half of pastors felt the economy was negatively impacting their churches and the first time since 2012 fewer than 10% of pastors expressed belief the economy was positively impacting their churches. Only twice in the study’s 15-year history—in 2018 and 2019—were pastors more likely to say the economy was having a positive impact than a negative one.

“The good news is the economy is not negatively impacting more churches than last year, despite persistent inflation and slower economic growth,” said Scott McConnell, executive director of Lifeway Research. “The bad news is that most churches continue to feel pain and discomfort from current economic realities.”

Churches maintain stable levels of giving

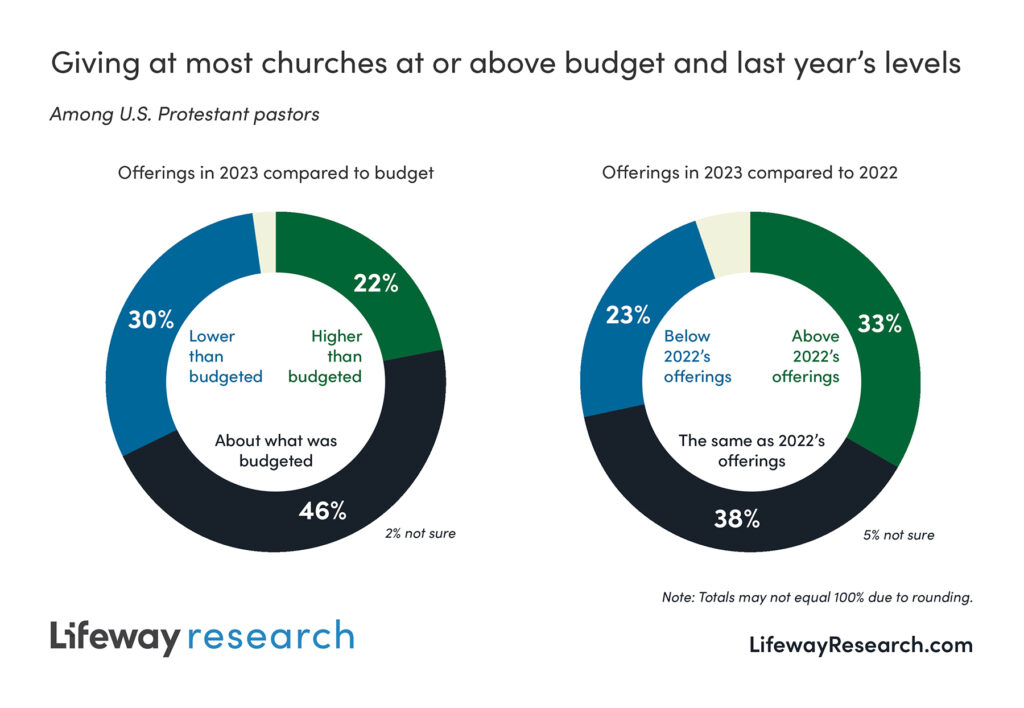

Although pastors continue to report a negative economic impact, churches have maintained stable levels of giving near their planned budgets and comparable to last year’s giving. But in most churches, increases in giving have not kept up with inflation in 2023.

Around 7 in 10 U.S. Protestant pastors say since the beginning of 2023, giving at their church is at or exceeding budget, with 46% saying giving has been about what was budgeted and 22% saying it’s higher. Three in 10 (30%) say giving is below their 2023 budget.

“This was not an easy year to set a budget, as many predicted a softening in the nation’s economic well-being,” McConnell said. “Whether churches lowered expectations or not, most are meeting or exceeding their budget.”

Compared to last year’s actual receipts, 7 in 10 pastors say giving at their churches is at or above 2022 levels, including 38% who say it’s the same as last year, and 33% saying it’s above. Fewer than 1 in 4 (23%) say offerings are below 2022.

When asked by what percentage their churches’ offerings have increased or decreased, more pastors say giving is the same as 2022 or above. More than 2 in 5 (44%) say it has remained the same, while 12% say giving has increased by 1-9%, 13% say it has increased by 10-24% and 4% say it has increased by 25% or more since 2022. Around 1 in 5 report a decrease in giving, including 4% who say offerings are down by 1-9%, 12% who say they are down 10-24% and 4% who say they have declined by 25% or more.

When the income experiences of churches are combined, the average church saw an increase of 0.79% in offerings from 2022 to 2023.

“Finances are not just difficult for those churches in which giving is down,” McConnell said. “Most churches are not seeing growth in offerings that keep pace with inflation (currently at 3.7% annually according to the Consumer Price Index CPI-U). So, many churches are still cutting spending and giving raises that are smaller than their pastors and staff need.”

Small churches face biggest setbacks

Although the economy’s impact on churches has remained stable compared to last year, small churches are still the most likely to face financial struggles. Small churches were some of the first to recover pre-pandemic levels of attendance after COVID-19, but many have struggled to face the economic challenges in the years since. Large churches are less likely to be struggling in the current economy.

Pastors at the largest churches (those with 250 or more in attendance) are the least likely to say the economy has somewhat or very negatively impacted their churches this year (34%). They are also the most likely to report that giving levels are above those in 2022 (57%).

“Finances are not just difficult for those churches in which giving is down. Most churches are not seeing growth in offerings that keep pace with inflation.” — @smcconn Click To TweetMeanwhile, pastors of churches with attendance less than 50 and 50-99 are among the most likely to say offerings have been lower than budgeted this year (35% and 32%, respectively) and below 2022’s offerings (27% and 24%, respectively).

“In a smaller church, if economic factors hurt even a couple of families, chances are the church feels it,” McConnell said. “There is no looking around expecting someone else to step up to cover it. It just hurts.”

Methodist congregations are also more likely to report economic troubles. Methodist pastors are among the most likely to say the economy has had a somewhat or very negative impact on their churches (56%). They are also among the most likely to report 2023 offerings have been lower than budgeted (39%) and below 2022’s offerings (28%).

Lifeway Research studies can be used and referenced in news articles freely. This news release can also be republished in its entirety on other websites and in other publications without obtaining permission.

For more information, view the complete report.

Methodology

The phone survey of 1,004 Protestant pastors was conducted Aug. 29-Sept. 20, 2023. The calling list was a stratified random sample, drawn from a list of all Protestant churches. Quotas were used for church size. Each interview was conducted with the senior pastor, minister or priest at the church. Responses were weighted by region and church size to reflect the population more accurately. The completed sample is 1,004 surveys. The sample provides 95% confidence that the sampling error does not exceed plus or minus 3.2%. This margin of error accounts for the effect of weighting. Margins of error are higher in sub-groups.

Comparisons are also made to the following telephone surveys using probability sampling:

- 1,002 pastors conducted Nov. 2009

- 1,000 pastors conducted March 2010

- 1,000 pastors conducted Oct. 2010

- 1,002 pastors conducted Jan. 2011

- 1,000 pastors conducted May 2011

- 1,000 pastors conducted May 2012

- 1,000 pastors conducted Sept. 2014

- 1,000 pastors conducted Jan. 2016

- 1,000 pastors conducted Aug. – Sept. 2017

- 1,000 pastors conducted Aug. – Sept. 2018

- 1,000 pastors conducted Aug. – Sept. 2019

- 1,007 pastors conducted Sept. – Oct. 2020*

- 1,000 pastors conducted Sept. 2021

- 1,000 pastors conducted Sept. 2022

*Mixed-mode telephone and online